NEW TECHNIQUES

The TD Range Expansion Index (TD REI)

by Thomas DeMark

Here, the author of The New Science of Technical Analysis and the brand-new New Market Timing Techniques explains how to use the TD REI and the TD Price Oscillator Qualifier.

Throughout my 26-year career in the investment business, I have studied and tested many widely followed market timing oscillators. Overall, I have questioned their construction, ambiguous interpretation and discretionary application. Consequently, I have developed my own series of indicators, and to simplify their application, I have assigned to them an objective interpretive process. In The New Science of Technical Analysis I presented the TD Range Expansion Index (TD REI), and now I have improved upon it, as explained in my latest book, New Market Timing Techniques. Here, then, is a discussion of salient TD REI components, as well as the trigger mechanism referred to as the TD Price Oscillator Qualifier (TDPOQ). The TDPOQ is critical to the proper application and execution of the TD REI as well as many other widely followed overbought/oversold oscillators.

My frustration with most conventional overbought/oversold oscillators stems from the steps typically used to calculate them. Most often, the method for calculation requires not just a comparison of two consecutive daily closing prices, but also a series of daily indicator values calculated by using exponential smoothing. Other than the fact that it has become market convention to perform these mathematical exercises for most widely followed indicators, there seems to exist no other reason to make such daily comparisons or complicated calculations.

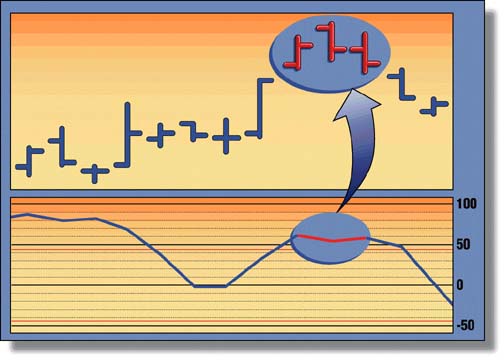

Figure 1: TDPOQ BREAKOUT PATTERN. TDPOQ requires both the open of the next trading day (A) be less than or equal to the previous uptrading day's high (B) and that day's high be greater than the upclose day's high (C).

Figure 2: BREAKOUT PATTERN. TDPOQ requires both the open of the next trading day (A) be both greater than or equal to the downclose day's low (B) and that same trading day's low (C) be less than the downclose day's low.

Tom DeMark is author of The New Science of Technical Analysis, as well as New Market Timing Techniques. TD Range Expansion Index (TD REI), TDPOQ, TD Duration Analysis, and TD Trap are registered trademarks.

Excerpted from an article originally published in the August 1997 issue of Technical Analysis of STOCKS &COMMODITIES magazine. © Copyright 1997, Technical Analysis, Inc. All rights reserved.