INTERVIEW

“To be successful at following a model, you should not try to tweak it every time something does not appear to be working.”

Technically Driven Money Management

The Danger Zone With Gregory Morris

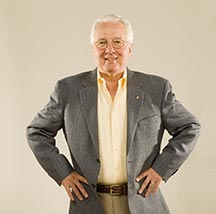

As chief technical analyst for Stadion Money Management, Gregory Morris educates institutional and individual clients on the merits of technical analysis, and it is why Stadion utilizes a technical rules-based model to oversee the management of more than $1.5 billion in assets in two mutual funds, separate accounts, and 401k plans.

Widely recognized as an expert on candlesticks and the developer of candlestick filtering, Morris has lectured around the world on the subject. From 1982 until 1993, he worked in association with N-Squared Computing, producing more than 15 technical analysis and charting software titles, some of which are still in active use today.

He holds a bachelor’s degree in aerospace engineering from the University of Texas, authored numerous investment-related articles, speaks at numerous seminars and investment groups, and has appeared many times on Financial News Network (Fnn), Fox Business, Cnbc, and Bloomberg TV. From 1971 to 1977, Morris was a Navy F-4 fighter pilot aboard the Uss Independence and graduated from the Navy Fighter Weapons School (made famous by the movie Top Gun).

In addition, Morris has written his second book, The Complete Guide To Market Breadth Indicators, introducing market breadth analysis for investors. A third edition to his best-selling and expanded Candlestick Charting Explained was released in March 2006.

Stocks & Commodities Editor Jayanthi Gopalakrishnan and Staff Writer Bruce Faber interviewed Greg Morris on July 8, 2009, via telephone and email.

Greg, how did you get interested in technical analysis?

I got involved with the markets in the 1970s. I had some friends who were fairly active in the market. I bought a couple of stocks, and the market took off and went up for a couple of months. When you are new, you think you are a genius. Unfortunately, I had no money management plan. I just thought I knew what I was doing. The value of these stocks dropped in the bear market of 1973–74 by about 60–65%. Of course, I held them all the way down, thinking the market was wrong and I was right. I knew then that there had to be another way to make investment decisions with a little more competence.

JG: So what did you find out?

I read The Art Of Low Risk Investing by Michael Zahorchak. He used five-, 15-, and 40-week moving averages on weekly data. He did a moving average on the New York Stock Exchange Composite, and he did it on the advance/decline line. He also put together a set of rules on how to invest and take stops when those four sets of data and their moving averages interacted. This was before even the Apple II had been introduced. I used chart paper with red, blue, and green pens, an old calculator, and a copy of Barron’s.

So every Sunday afternoon I would sit down and chart the A/D line, the New York composite, and about 40 or 50 stocks that I followed, all using weekly data. What was interesting is that I got more involved in doing that than I did in actually following it and investing. I don’t think that is abnormal. It is just that you get caught up in the mechanics of analyzing the market. When the Apple II finally came out, I bought one because it allowed me to do moving averages. I wrote a program to calculate moving averages.

JG: What happened?

In Barron’s I saw an ad for a program called the Market Analyzer by N-Squared Computing. I bought it and was very impressed with it. I wrote a letter to the developer and made some suggestions as to what he could do to enhance his program. About a month later, I got a 5¼-inch Apple II diskette in the mail. The letter attached said, “Here’s all the changes you suggested. Keep them coming.” That started a relationship with Norm North at N-Squared Computing. We worked together until 1993. We must have produced 15 technical analysis, charting and indicator building packages. We are good friends to this day.

JG: What did you put together?

We did a candlestick charting package. In fact, I got a call from Irwin Publishing asking if I would consider writing a book on candlestick charting. So the candlestick charting book was published in 1992. McGraw-Hill bought Irwin in 1995. The second edition came out with a new title, Candlestick Charting Explained, and a new cover. In 2005, McGraw-Hill asked if I would consider a third edition. Well, I did. I almost doubled the size of the book, and it is still selling really well.

In 1993, Norm and I were confronted with Windows, and we decided that a Windows version was beyond our desires because it was a whole new programming language. So I joined forces with a couple of guys in Dallas and a company called MarketArts. We launched a program called Windows On Wall Street, which was the first Windows-based charting package.

Then they started going in a different direction so I started G Morris Corp. I developed a huge supply of indicators and trading systems. I basically started with every issue of Technical Analysis of Stocks & Commodities and reproduced every indicator or system, whether or not it was defined rigidly in the magazine. Some of it was just text, so I took the author’s concept and developed indicators and trading systems for it. I did that up through 1995 or 1996. That has been put on CD now. There were nine volumes. They are not indicators and trading systems to get rich with. They were just the formulas. You can take the code out of there for TradeStation or MetaStock and develop your own. It is a library of computer codes for indicators and systems.