Explore Your Options

Explore Your OptionsQ&A

Explore Your Options

Explore Your OptionsGot a question about options? Tom Gentile is the chief options strategist at Optionetics (www.optionetics.com), an education and publishing firm dedicated to teaching investors how to minimize their risk while maximizing profits using options. To submit a question, post it on the Stocks & Commodities website Message-Boards. Answers will be posted there, and selected questions will appear in future issues of S&C.

DOUBLE SPREADS

At a recent seminar, I was asked what might be the best way to take advantage of a stock that drops after an earnings disappointment. I knew what stock he was talking about — Apple (AAPL). Just a week earlier, I had created a case study for AAPL just after the earnings report. Here’s a typical post-earnings drop on a big-name stock, as well as one strategy to look at trading when this occurs.

Typically, post-earnings disappointments are not from good stocks. Companies post earnings outside of the daytime trading sessions, usually announcing after the market close or before the market opens. Often, this results in a gap occurring, as the stock will most likely drop. Unless you want to trade the after- or before-market sessions, as option traders we are limited to trading when the market opens in New York following the announcement. Because after- and before-market announcements give us an idea of where the stock will be trading during the next-day session, it gives us time to set up a strategy.

Typically, the option market gets stirred up right before an important earnings announcement, and implied volatility gets higher than average. After the announcement, the next session will usually see the stock price move, either up (for positive earnings announcements) or down (for negative), but option premiums will most likely fall either way. But there are rare occurrences when a stock drops, and the time premium in options will not fall as fast. This presents an opportunity for the option seller. But how do we sell premium and protect ourselves from unlimited risk? Spreading. And how do we create a trade that’s neutral in direction and risk? Double spreading!

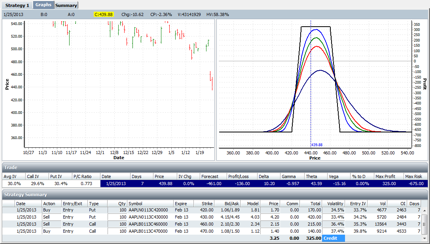

A double spread is another word for condor, which involves selling both an out-of-the-money (OTM) call and put spread around the stock’s range. I like condors when a popular stock breaks down off an earnings report. Such is the case with AAPL, as the stock has fallen from 700 to below 430 in just two months. This downward price action caused option time premiums to rise, and even after the latest earnings reports, volatility didn’t fall as fast as normally. This two-day move after earnings created a range in which to create the condor spread. See Figure 1.

FIGURE 1

This condor case study involves the Apple 430/420 put spread and the 460/470 call spread. This trade shows a credit of $325. There are a few scenarios that could occur during this short time frame. The favorable scenario is for Apple to stay between the spreads before the February expiration date. If it does, the spread will deteriorate to zero, allowing us to keep the credit. If Apple climbs above 460 or below 430, risk could set in. If Apple climbs above 470 or below 420 by expiration, the trade would see maximum risk. The risk shown in this trade is $675. We determine this by taking the distance between the strikes (10) and subtracting the full credit received (3.75).

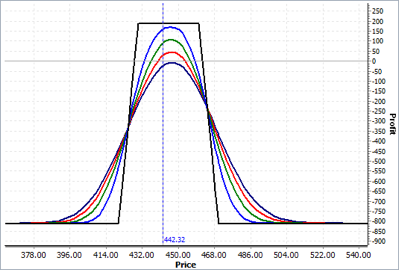

Figure 2 shows what has happened as Apple has moved in a sideways formation over the last week. The time has decayed and now the same condor can be closed out for 1.88. If we sold the condor for 3.75 and it can be bought back for 1.88, that would leave us with a profit of 1.88, or nearly 50% of the spread in one week. What is our return on investment? We would have to look at the risk of the trade minus the profit as of now.

FIGURE 2

The risk of this trade was $625. If we look at 1.88 profit on a risk of $625, we can see that our return on investment is 30% as of now. Should we take our profits or leave the position open for another week and try to get maximum profit? That depends on your system. Remember, staying in until expiration can cost you money if you’re wrong. Consider taking some profits, especially if you make half of the maximum reward, as in this case study.

The iron condor strategy involves selling OTM call and put spreads to capture premium from options whose stock is believed to move sideways to expiration. Though probability is on your side, the risks outweigh the rewards, so make sure you have good reason why a stock would move sideways to allow for consistent returns. The good news is that risks in this strategy are always fixed and limited. Stay hedged!