AT THE CLOSE

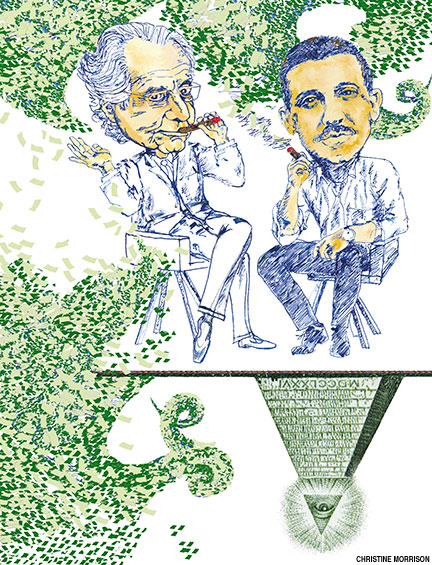

Avoiding The Ponzi Pusher

Don’t be a pushover for the pusher!

The name of Charles Ponzi, the Boston financier and swindler, has come to symbolize the idea of fraudulent investment operations where investors are paid handsome returns by subsequent investors rather than from profits. This activity is known elsewhere as illegal pyramiding, but whatever the name, a Ponzi scheme is where the victim of the scheme is forever separated from his or her money by underhanded means. The victim’s greed gets the best of them and the swindler takes advantage.

Avoid being a victim.

Walk away

With so many large-scale Ponzi schemes coming to light as a result of these turbulent times (with Bernard Madoff and R. Allen Stanford recent names in the headlines), it is a good time to consider how you can easily avoid being victimized by this type of investment fraud. It is not that difficult. There are three easy questions/checks you can do to avoid the Ponzi pusher:

- Request an investment advisor’s Crd number. Every registered advisor has a Crd number. The Crd (Centralized Registration Depository) number uniquely identifies an advisor, and the history of that advisor is contained in a computer database jointly administered by state regulators and the North American Security Dealers (Nasd). Given this number, you can use the Internet to do a quick check on the advisor. The Crd number lookup can be performed at the Url given under the “Suggested reading” at the bottom of this article. If you request an advisor’s Crd and they either don’t have one or don’t offer to share it, then something is not right. Walk away.

- Read the advisor’s prospectus document. A financial advisor is either regulated by the state or by the Securities and Exchange Commission (Sec). Both require that they provide a prospectus document that discloses the risk you take as an investor. If they don’t have a prospectus or if you can’t understand it, walk away.

- Ask if your investment is guaranteed. If you ask for a guarantee and the advisor offers one, then run away — don’t walk! Nothing in this life is guaranteed, and certainly not a return promised by some investment advisor!

Although these three simple checks do not guarantee you will not end up as the Ponzi pusher’s latest victim, there is one other step you can take to make it almost impossible — simply do not hand over your money to an advisor. You cannot end up being a victim unless you give your money to the pusher. A Ponzi scheme requires control of your funds. At some point in the process, the Ponzi pusher will require you to put your money in his or her hands. It may be that you deposit money into some investment account that they have set up, or you write a check to their firm in return for a piece of paper showing that you have made a deposit with them — but don’t do it. Only put your money into an investment account that is in your name, that is with a reputable third party (not affiliated in any way with the investment advisor), and which you have control of.

A legitimate investment advisor does not require control of your money. Their job is to advise you. They are there to help you make investment decisions. Neither requires control of your funds. They may have trading rights that you give them, but they should never have deposit and withdrawal rights to your money!

Removing all doubt

A Ponzi pusher offers the world and takes yours away. They entice you with pie-in-the-sky returns, but give you none. By asking for their Crd number and doing a quick check on them, reading and understanding their prospectus, and ascertaining if the returns are guaranteed, you can remove 95% of the Ponzi pushers before they ever get any farther.

In the end, though, even if all the above fails to protect you, not allowing them to have withdrawal access to your funds will defeat their plans, no matter how resourceful they may be.

Suggested reading

Little, L.A. [2009]. “The Measure Of A Trader,” At the Close, Technical Analysis of Stocks & Commodities, Volume 27: May.

• www.adviserinfo.sec.gov/IAPD/Content/Search/iapd_OrgSearch.aspx