CLASSIC TECHNIQUES

by Daryl Guppy

Manage your trades using technical analysis by identifying risk points as well as setting profit objectives. This Australia-based author shares some of his favorite techniques.

Most of us think trading is a rational process, but many private traders approach trading the same way that other people approach a wishing well. Those people throw money into the well, make a wish and wait for their wish to come true. In the same vein, some private traders throw money into the market and all they wish for is a profit. Sometimes the wish comes true, but most times, just like a wishing well, it is a waste of money and time. For traders using the market as a substitute for a wishing well, trading is a very emotional experience.

With that in mind, let's take a closer look at the way emotion interferes with good trading and at some of the ways that chart analysis can help us establish trading objectives more effectively.

Most readers will protest that trading is not like a wishing well; we don't just toss money in and hope for fat profits. By and large, we prefer to believe that we are too sophisticated for that. Instead, we analyze the tradable instrument in question, applying sound technical analysis to charts and price data, and then, and only then, make a trading decision. This is a rational process, and if our analysis is correct, the tradable's price will increase when we go long.

Unfortunately, describing the entry decision in pretty words and trading jargon does not alter the trader's intent nor the outcome. Trading based on the wishing-well approach is characterized by poor trade management illustrated by the lack of a plan. Just hoping to make a profit is not a plan. It is an objective, but it tells us nothing about how we are going to get there.

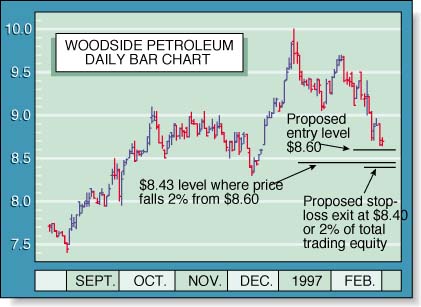

FIGURE 1: WOODSIDE PETROLEUM. Assume that all the sound analysis has been done, and Woodside appears to be irresistible at $8.60. As prices tumble toward the chosen entry level, the trader must concentrate on the possibility that his or her decision might be wrong.

Daryl Guppy is a full-time private position trader. He is the author of several books, including Share Trading: An Approach to Buying and Selling (with editorial assistance from Alexander Elder) and Trading Tactics: An Introduction to Finding, Exploiting and Managing Profitable Share Trading Opportunities and Trading Asian Shares: Buying and Selling Asian Shares for Profit. He is a regular contributor to the Sydney Futures Exchange magazine. He can be contacted via E-mail at www.ozemail.com.au/~guppy.