NOVICE TRADER

by John Sweeney

Designing a profitable trading system is key, but the way that profits and losses vary can have an impact on your long-term success. Here's why looking at how the returns deviate can help you design your own system.

Traders spend a lot of time worrying about the proper trading signals. Then they think about stops, and sometimes they even worry abut exits. (Not to mention complementary trades, diversification and capital management.) Hardly anyone, assessing his trading system, worries too much about its volatility. In most trading system evaluation software, volatility -- the variability of the returns it provides -- is not covered at all.

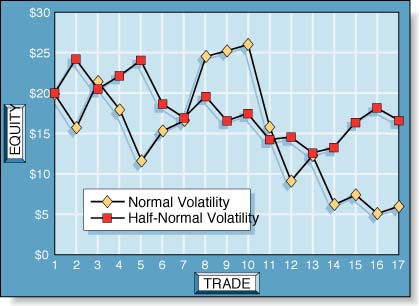

Even so, volatility does have some unexpected impact on a system's usefulness and therefore on your wealth at the end of the day. All things being equal, the system with the lower volatility will beat the system with higher volatility.

IN SEQUENCE

Trading a system is a sequential activity. What happens in one trade affects the ending wealth of the next trade, since there will be less or more to invest, depending on results. The entire campaign of trading produces a sequence of trades, each with a return. Some returns (beginning value less ending value divided by beginning value) are big, some are small, some are negative. The annualized standard deviation of these returns is volatility, or "risk."

As an example, low volatility of returns would be something like a Treasury bill -- we always get what we expect to get and the amount varies with the fluctuation of interest rates. Therefore, measured volatility varies with the changes in the rate environment. In contrast, a trading sequence is never known in advance and fluctuates from huge gains to, hopefully, small losses. Each is a "return," even if negative. This great difference in the return from trade to trade is an example of the greater volatility of trading returns.

FIGURE 1: COMPARING RETURNS. Here's a striking example of how the simulated lower-volatility returns netted out a higher profit, compared with the returns that had half of the volatility.

John Sweeney is Technical Editor of STOCKS & COMMODITIES.